Dhuandhar Falls

A stunning waterfall on the Narmada River, known for its misty spray and scenic beauty.

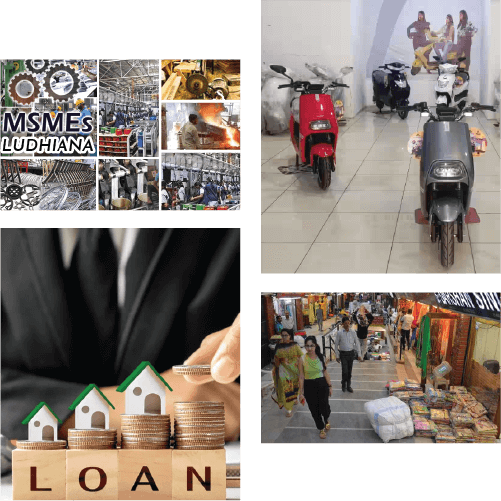

Jabalpur’s manufacturing and defence industries drive demand for MSME loans, machinery, and working capital.

Known for wheat, pulses, and oilseeds, Jabalpur fuels demand for crop loans and tractor financing.

Markets like Gorakhpur and Sadar Bazaar support loans for merchant credit and POS financing.

Developing areas like Vijay Nagar and Rampur drive demand for home loans and construction financing.

Served by NH 34 and railway networks, Jabalpur supports loans for logistics and vehicle financing.

Jabalpur’s natural attractions fuel demand for hospitality loans and tourism-related financing.

A stunning waterfall on the Narmada River, known for its misty spray and scenic beauty.

Magnificent white marble cliffs along the Narmada, ideal for boating and photography.

A historic fort atop a hill, built by Gond rulers, offering panoramic city views.

A museum showcasing Gondwana artifacts, sculptures, and regional history.

An 11th-century temple dedicated to 64 Yoginis, perched on a hill with serene surroundings.

A scenic dam on the Narmada River, offering boating and sunset views.

Industry drives demand for MSME and machinery loans.

Agriculture fuels crop and tractor financing.

Real estate supports home and construction loans.

Tourism drives hospitality and event financing.

Retail markets driving demand for merchant credit and POS financing.

Residential zones fueling home loans and construction financing.

Agricultural areas needing crop loans, tractor financing, and irrigation credit.

Manufacturing and defence sectors driving MSME and machinery loans.